The fixed deposit interest rate in Nepal has always been discussed as one of the most profitable investments in Nepal. A Fixed Deposit (FD) is a type of financial instrument, provided by banks and other financial institutions, which offers investors a higher rate of interest than a regular savings account, until the agreed maturity date.

The investor is not able to access the funds during the fixed term but can do so after, subject to conditions. There are many reasons why people choose to invest in a Fixed Deposit. There are many advantages of having a fixed deposit in the bank. Here are some of the advantages:

FD is a safe and secure investment option.

Fixed Deposits offer higher interest rates than savings accounts.

They are a good way to save money for specific goals.

FD can be used as collateral for loans.

They are easy to set up and manage.

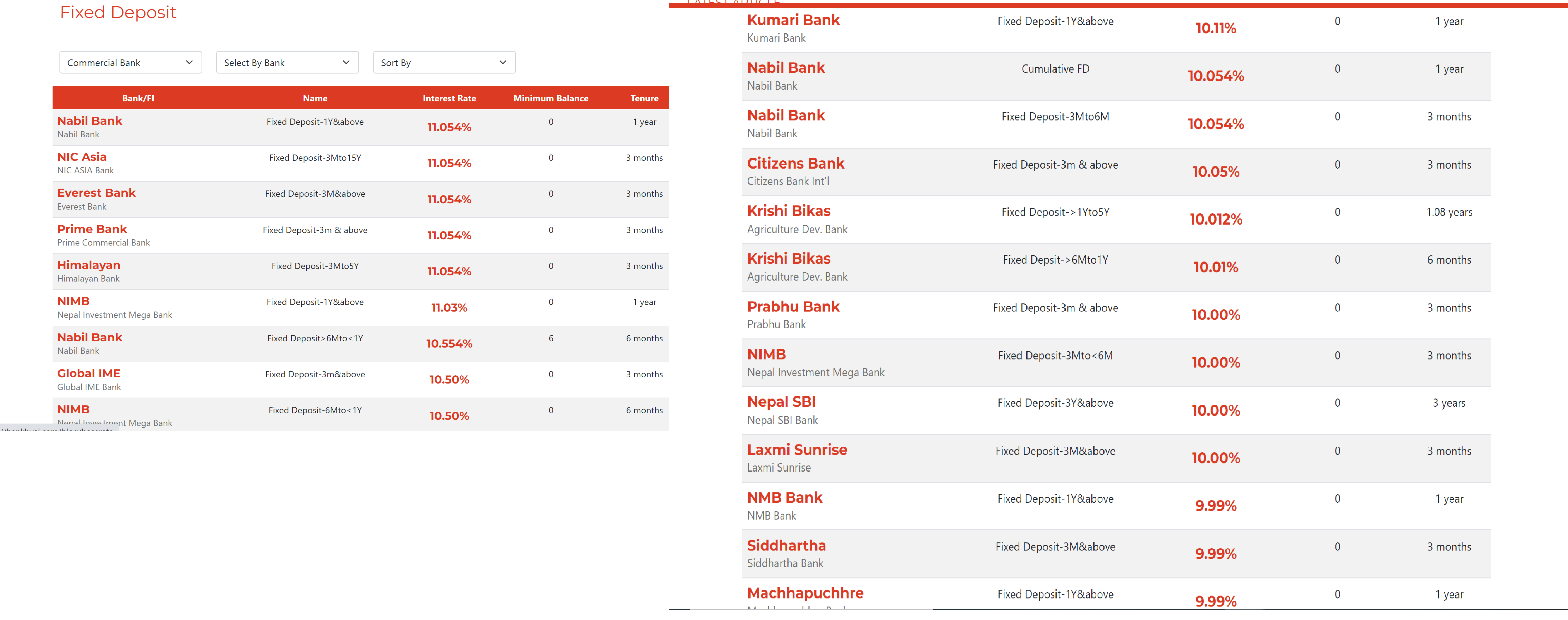

In a significant departure from the recently increased interest rates by the Nepal Bankers' Association. Commercial banks have now embraced individualized interest rate structures for the upcoming Bhadra month (mid-September to mid-October). This move has resulted in varying rates, especially for fixed deposits, with a majority of banks opting to increase their rates.Most commercial banks are offering an annual interest rate of approximately 5% for depositors who maintain savings accounts during Ashwin. Meanwhile, individual customers have the opportunity to earn a maximum interest rate of 11.36% per annum on fixed deposits (FDs), whereas institutions can secure an interest rate of 9.36% per annum on their fixed deposits.

It is worth noting that, SCB has chosen to reduce its rates, offering the lowest rates among all 20 commercial banks, with a 5.29% interest rate for institutional FDs and a 7.79% interest rate for individual FDs. In contrast, the standard savings rate at SCB remains at 5.9%. In a comparative analysis, Nepal SBI Bank has set its institutional FD rate at 6.2%, while the individual FD rate stands at 8.2%.

Prime Commercial Bank Limited (PCBL) boasts the highest FD rates among all commercial banks, offering an institutional FD rate of 9.36% and an individual FD rate of 11.36%. However, PCBL's regular savings account provides a yield of 6.36%- 8.36% which is again higher than that of any other commercial bank.

Furthermore, Everest Bank Limited and Himalayan Bank Limited have slightly elevated interest rates for their institutional and individual FDs, with rates of 9.05% and 11.05%, respectively. Concurrently, both banks maintain general savings rates at 6.05%.

Similarly, in simpler terms, Nepal Rastra Bank mandates that banks cannot change their savings and fixed deposit interest rates by more than 10% compared to the rates they published in the previous month.